Girl, Here's How You Can Get Grants to Level Up Your Business!

Introduction: Alright, sis, let's talk about something major—grants! I know the struggle of trying to get your business off the ground or take it to the next level without drowning in debt. But here's the tea: there's free money out there just waiting for you to grab it! That's right—grants. They're like the ultimate hookup for boss babes like us who need a little extra financial assistance to make big moves without paying it back. Let's dive in and get you that grant funding!

Section 1: What Are Business Grants? So, first things first—what even is a grant? Think of it like a gift card for your business, but instead of buying cute shoes, you're investing in your hustle. Unlike loans, which you have to pay back (ugh, no thanks), grants are non-repayable funds given to businesses to help them grow. There are all kinds of types of business grants out there—from government grants to those from nonprofit organizations or big corporations. The trick is knowing which one is the right fit for you and your business.

Section 2: The Benefits of Applying for Grants Let me tell you why applying for small business grants is a no-brainer. First off, it's free money, and who doesn't love that? It's like getting a boost without the strings attached. This extra capital investment can help you do everything from hiring more people to finally launching that product you've been dreaming about. Plus, when you get a grant, it's like getting a gold star—people will take your business more seriously because someone else believed in you enough to invest in you.

Section 3: How to Find the Right Grants for Your Business Now, let's get real about finding the right grant programs for small businesses for you. Start by figuring out what exactly you need the money for. Are you looking for business expansion? Do you need funds for marketing or research and development grants? Once you know what you need, the search for available grants for small businesses becomes easier. Check out government websites, grant directories, or even industry-specific associations—they're gold mines for finding funding opportunities. Just make sure you meet the eligibility requirements before you get too excited—read the fine print to avoid wasting your time.

Section 4: Tips for a Successful Grant Application Alright, sis, here's where you need to bring your A-game. A strong business plan is key—it's gotta show that you know what you're doing and where you're headed. Be super clear about how you're going to use the grant funding. Grant providers love it when you have a plan for economic development and job creation. And please, please, please follow the application instructions to the letter. It might seem boring, but it's crucial. And don't forget to make it look good—presentation matters, so put your branding skills to work!

Section 5: Common Mistakes to Avoid We've all been there—rushing through something only to realize we missed something important. When it comes to grants, that can cost you. So, don't leave anything blank, and triple-check that you've filled out everything. Grant deadlines? They're not suggestions. Set reminders if you need to, but don't miss them. And after you hit submit, don't just sit and wait. Follow up if you can—it shows you're serious and could give you an edge in grant competitions.

Section 6: Success Stories Now, I know you might be thinking, "Does this really work?" Let me tell you—it does! I've seen other boss babes get grants and completely transform their businesses. Whether it's expanding their team, launching a new product thanks to innovation grants or technology grants, or just getting the visibility they need to attract more clients, grants have been a game-changer. Imagine what small business grants could do for you!

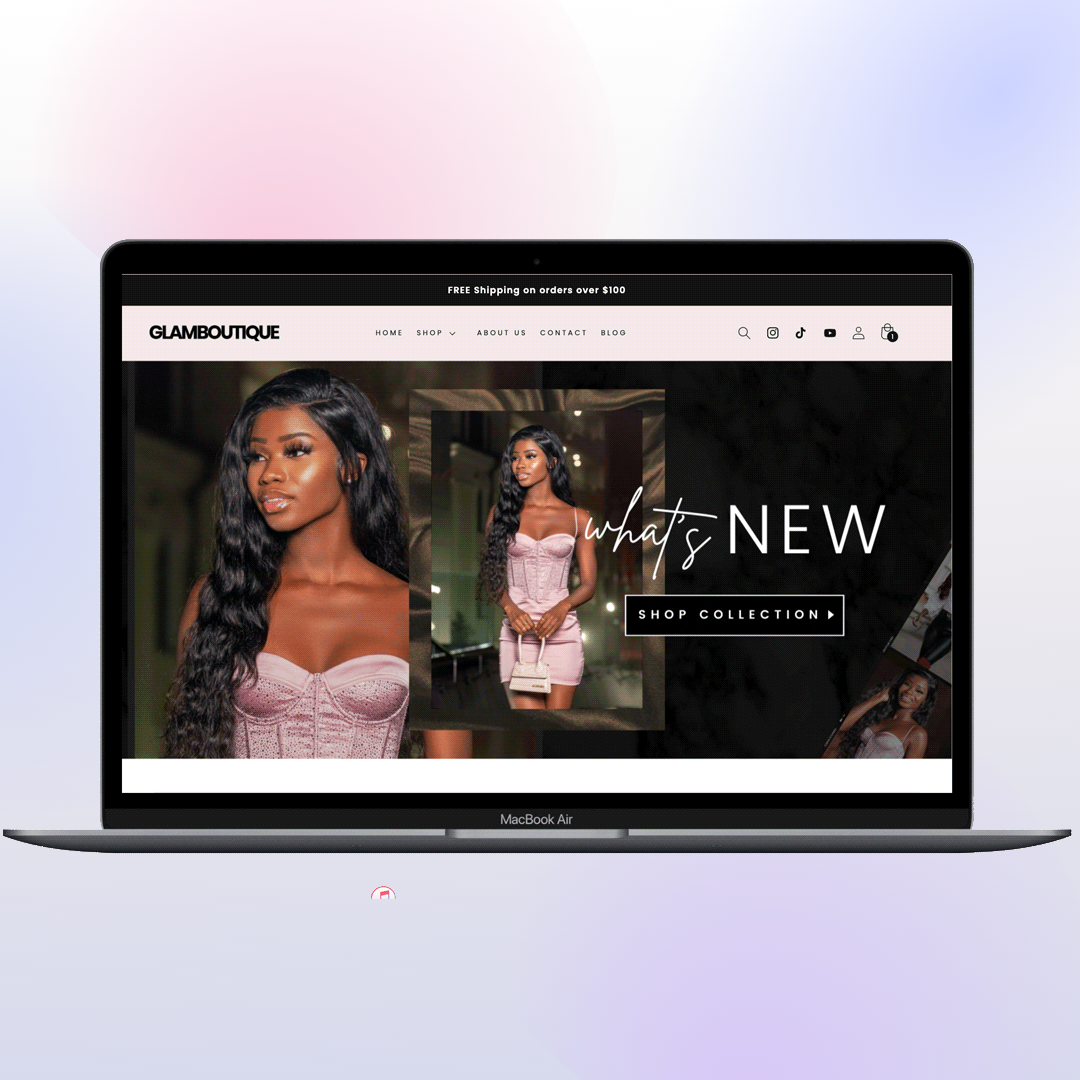

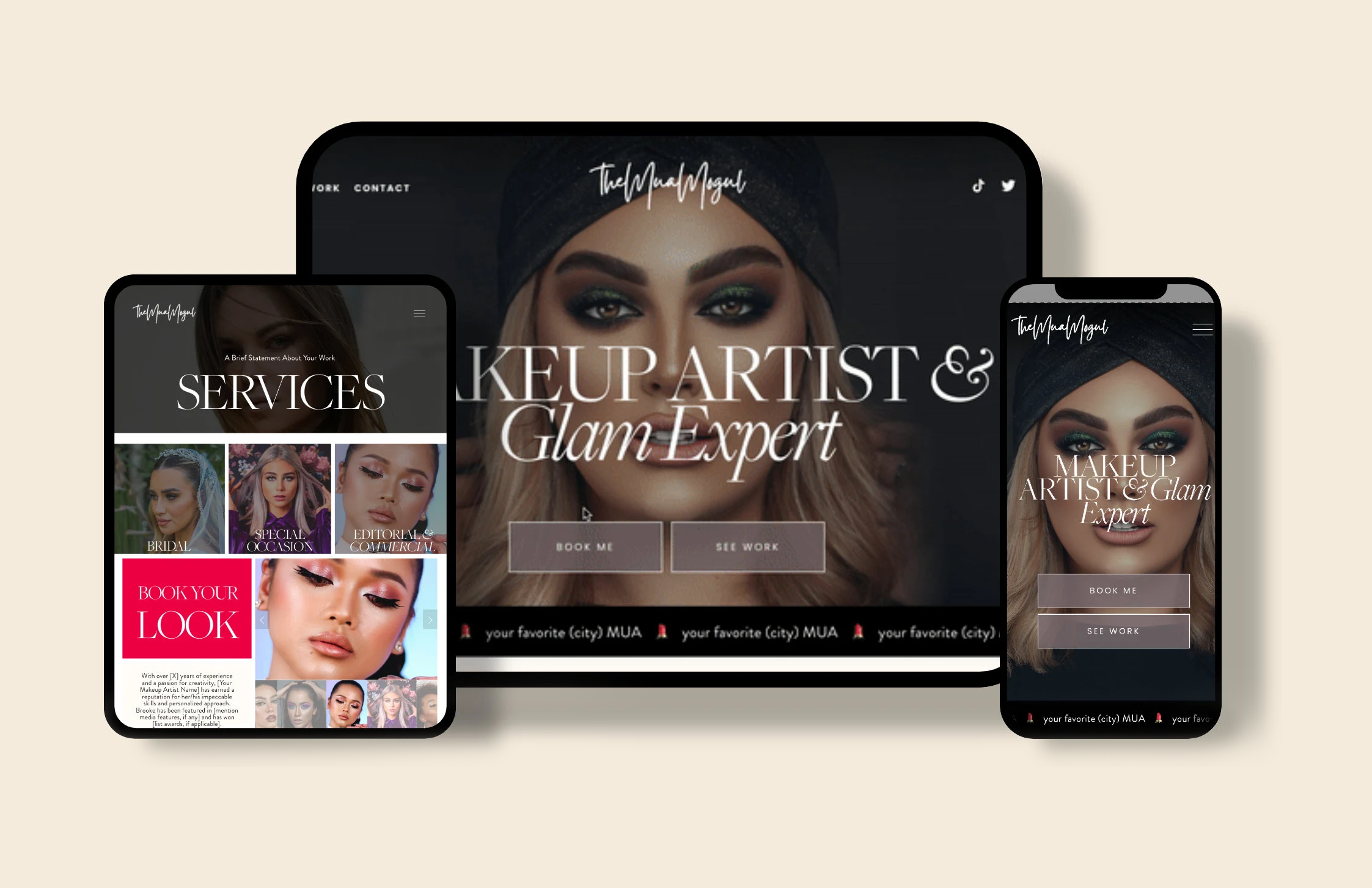

Conclusion: So, what are you waiting for? It's time to get out there and secure that bag! Start researching those grants that match your business goals, whether they're federal grants, state grants, or local grants. And remember, you're not in this alone—GlamLaunch has your back. We can help with everything from business planning to branding, and even making sure your grant application is on point. Let's make it happen and get you that business financing!

Closing Thoughts: You've got this, girl! With the right resources and a little bit of hustle, you can take your business exactly where you want it to go. Don't be afraid to go after what's yours—those grants are out there for a reason, and they're meant for women like us who are ready to make big moves. Let's get to work and apply for small business grants!

FAQ: All About Securing Business Grants

1. What exactly is a business grant? A business grant is basically free money that you don't have to pay back. It's given to businesses by the government, nonprofit organizations, or big companies to help you grow. Unlike loans, there's no interest, no repayment schedule—just funds to help you get where you want to go.

2. How do I know if I'm eligible for a grant? Eligibility varies depending on the grant. Some are specifically for women-owned businesses, others might be startup grants or grants for starting a business in certain industries. The best thing to do is carefully read the grant guidelines before applying to make sure you meet all the criteria.

3. Where can I find business grants? There are a few go-to places to search for grants: Government Websites, Grant Directories, and Industry Associations. You can find government startup grants, new business grants, rural grants for small business, corporate grants for small business, federal grants for small business start-up, and more.

4. How do I apply for a business grant? Applying for a small business grant usually involves filling out an application form, submitting a detailed business plan, and sometimes providing financial documents or a pitch deck. Each grant will have its own specific requirements, so be sure to follow the instructions closely.

5. What should I include in my business plan for a grant application? Your business plan should be clear and concise, covering your business idea, market research, financial projections, and how you'll use the grant funding.

6. How long does it take to hear back after applying for a grant? It varies, but can take anywhere from a few weeks to several months. Always keep track of your applications and follow up if you haven't heard back within the expected time frame.

7. What are my chances of getting a grant? It can be competitive, but it's definitely possible! Your chances depend on how well your business aligns with the grant's goals, how well you present your case, and sometimes, a bit of luck. Pitch competitions can also increase your chances.

8. Can I apply for more than one grant? Absolutely! You can apply for small business grants as many as you're eligible for, just make sure to tailor each application. Look for new york state grants, grants for startups 2024, government help to start a business, small business startup grants, free grants to start a business, and more.

9. What if I don't get the grant? If you don't get the grant, don't stress. There are plenty more out there, and you can always improve your application for the next one. Ask for feedback to make your next application even stronger. Keep an eye out for small business hardship grants, veteran-owned businesses grants, minority-owned businesses grants, and disaster relief grants.

Here are some useful links where small business owners can find grants:

- U.S. Small Business Administration (SBA) Grants: The SBA provides grants to nonprofits, Resource Partners, and educational organizations to support entrepreneurship through counseling and training programs. While SBA does not offer grants for starting or expanding a business, it does provide grants for community organizations and research and development programs.

- North Texas Small Business Development Center (SBDC): This site offers a collection of over 200 grants available for starting or growing a small business in Texas, including grants for women, minorities, and veterans. It also features specific grants like the Bizee's Fresh Start Business Grant and the NASE Growth Grants.

- U.S. Chamber of Commerce - CO: This resource lists various free grants and programs for small businesses, including the Fast Break for Small Business grant program and the GoFundMe Small Business Relief Fund.

- Dallas Metropolitan SBDC: Provides information on various small business grant programs, including the Skills for Small Business Grant and the Fiserv + Clover Back2Business Grant for minority-owned businesses.

- NerdWallet's Small-Business Grants Guide: Offers a comprehensive guide to federal government grants, corporate small-business grants, and specialty grants aimed at specific communities. It includes programs like the USDA Rural Business Development Grant and the National Association for the Self-Employed Growth Grant.

These resources provide a range of options for small business owners seeking financial assistance through grants.

I too would like a grant to open a office space for my freelance graphic design business , as well as a broker office for stock investing and consulting. Text me the information 4235670898. GREAT!